Team Member Guide to Benefit Enrollment

Franciscan Missionaries Of Our Lady Health System

My Bene昀椀ts 2023 Team Member Guide to Bene昀椀t Enrollment

Information Resources Your 2023 Total Rewards Just as our team members are more than job descriptions and titles, our rewards program is more than just compensation and bene昀椀ts. Total Rewards is our commitment to provide value to you and your family throughout your career at Franciscan Missionaries of Our Lady Health System. It combines six distinct areas that you can use to meet your individual and family needs: My Purpose, My Compensation, My Bene昀椀ts, My Personal Growth & Development, My Recognition, and My Health & Well-Being. When all of these components are tied together, they create a Total Rewards package that is unique to our organization. This guide will help you understand more about the rewards available to you as a team member of FMOLHS. Bene昀椀t Education Our goal is to make bene昀椀ts easy to understand so you can make the most of them. We have an interactive online learning experience available on our Total Rewards page. In this interactive learning experience, you can pick and choose the topics you want to dive deeper into. Check out all of the education resources available by visiting the page today. » Click here for the Total Rewards page » Click here for 2023 Interactive Bene昀椀t Education Video or scan the QR code at right to directly access the bene昀椀t education video » Click here to review the FMOLHS EPO and PPO Network » Click here to learn about FMOLHS Network Navigation Resources to help you help 昀椀nd a provider in our network. Have Questions? Need assistance with your Bene昀椀t Enrollment? The FMOLHS askHR Team is available by phone or email. » Phone: 833-482-7547 » Email: [email protected] Note In addition to these resources, we are committed to keeping you informed. Stay up to date on the latest communication and updates through: Oracle Employee Self Service, your FMOLHS email, fmolhs.org/TotalRewards and TeamTalk. 2

Your 2023 Enrollment Options Your enrollment options will be displayed in Oracle Employee Self-Service in the following order: NEW ENROLLEE FUTURE ENROLLEE BENEFIT PLAN FMOLHS HEALTH PLAN HEALTH SAVINGS ACCOUNT (HSA) MEDICAL FLEXIBLE SPENDING ACCOUNT (FSA) Team members who are within their 1st 30 Enroll through Oracle Employee Self-Service calendar days of eligibility may enroll through LIMITED MEDICAL FLEXIBLE SPENDING ACCOUNT (LUFSA) annually during the Open Enrollment period. FMOLHS DENTAL PLAN Oracle Employee Self-Service. VISION PLAN LINCOLN VOLUNTARY EMPLOYEE LIFE Team members who are within their 1st 30 For those outside of their 1st 30 calendar days of LINCOLN VOLUNTARY SPOUSE LIFE calendar days of eligibility may enroll through eligibility, enrollment in coverage is not available. LINCOLN VOLUNTARY DEPENDENT LIFE Oracle Employee Self-Service. Team members who previously waived Team members who are within their 1st 30 coverage must complete evidence of insurability LONG TERM DISABILITY calendar days of eligibility may enroll through online during the Open Enrollment period at Oracle Employee Self-Service. MyLincolnPortal.com for eligibility review. LINCOLN VOLUNTARY ACCIDENT Team members who are within their 1st 30 Enroll through Oracle Employee Self-Service calendar days of eligibility may enroll through LINCOLN VOLUNTARY CRITICAL ILLNESS annually during the Open Enrollment period. Oracle Employee Self-Service. COMPANY-PROVIDED GROUP LIFE INSURANCE Company-provided Basic Life Insurance Eligible Team members are automatically coverage. Team members do not need to enroll. enrolled in the Basic Life Insurance. GROUP BASIC LIFE (COMPANY-PAID) Team members do need to designate a Team members do need to designate a bene昀椀ciary in Oracle Employee Self Service. bene昀椀ciary in Oracle Employee Self Service. 403(b) AND 457(b) RETIREMENT ENROLLMENT PROCESS 403(b) AND 457(b) RETIREMENT PLANS Eligible Team members enroll at Eligible Team members enroll at LincolnFinancial.com/FMOLHS LincolnFinancial.com/FMOLHS You can verify your enrollment and print a copy of your elections in Oracle Employee Self Service by clicking on Me/Bene昀椀ts/My Bene昀椀ts. Note Most bene昀椀ts are effective on the 昀椀rst day of the month following 30 days of employment. Long Term Disability bene昀椀ts are effective 昀椀rst of the month following 6 months of employment. (New Hire date: March 5; bene昀椀ts are effective on October 1.) 3

Table of Contents All eligible Team 5 Important Information Members must enroll 7 Enrollment within 30 days of 11 My Health Bene昀椀ts new hire/new 12 Navigating Our Network eligibility date. 25 My Phar macy Bene昀椀ts 28 Pr eauthorization Requirement List 32 My Health and W ell-Being 35 My Dental Bene昀椀ts 37 My Vision Bene昀椀ts 39 My Health Savings Accounts – HSA 41 My Flexible Spending Account – FSA 43 My Life Insurance 44 My Retirement Bene昀椀ts 47 My Disability Insurance 48 My V oluntary Bene昀椀ts 52 My EAP 54 My Discounts 58 Requir ed Notices 66 Important Contacts In this guide we use the term “Company” to refer to FMOLHS. This guide is intended to describe the eligibility requirements, enrollment procedures, and coverage effective dates for the bene昀椀ts program offered by the Company. It is not a legal plan document and does not imply a guarantee of employment or a continuation of bene昀椀ts. This guide is not intended to answer all of your questions, but to provide you with a tool to answer most of your questions. Full details of the plans are contained in the Plan Documents, which are available on your facility intranet and govern each plan’s operation. Whenever an interpretation of a plan bene昀椀t is necessary, the actual plan documents will be used. 4

Important Information Enrollment for the 2023 Plan Year Complete your bene昀椀t enrollment and submit complete dependent veri昀椀cation documentation within 30 calendar days of your new hire/new eligibility date (e.g. for a new hire date of May 1, enrollment and documentation deadline is May 30). If you meet the income guidelines, apply for the health plan premium reduction, Just Premium, within 30 calendar days of your eligibility date (see page 10 for details). Member Cards Team Members who enroll in the following bene昀椀ts will receive member identi昀椀cation cards: » Medical Cards – FMOLHS Health Plan through Blue Cross Blue Shield (BCBS) » Dental Cards – Delta Dental » Vision Cards – UNUM » Medical Flexible Spending Account (FSA)/Health Savings Account (HSA) – Pay昀氀ex Human Resources Contact Reach out using the method that works best for you: » Submit an Oracle Service Request by clicking on Help Desk/HR Service Requests.* » Email [email protected] » Call 833-4UaskHR (833-482-7547) *This is the fastest method for getting an answer to your question. Note If you (and/or your Dependents) have Medicare or will become eligible for Medicare in the next 12 months, a Federal law gives you more choices about your prescription drug coverage. Please see page 58 for more information concerning Medicare Part D coverage. 5

Important Information Be Healthy. Be Happy. Register for My Health Toolkit to help you get started. You will have anywhere, anytime access to your bene昀椀ts information, insurance cards, claims and covered local providers. Download the My Health Toolkit mobile app. It’s free at: www.MyHealthToolkitLA.com/links/FMOLHS. Get Started Today Why wait? It’s easy to sign up. In just a few clicks, you will have everything you need at your 昀椀ngertips. 1. Go to www.MyHealthToolkitLA.com/links/FMOLHS and select Register Now. 2. Enter the number on your membership card and your date of birth. If you don’t have your membership card, you can enter your social security number. 3. Choose a username and password. 4. Enter your email address and choose to go paperless, if you would like. Your Membership Card Your Blue Cross Blue Shield membership card contains important information that helps providers apply your bene昀椀ts correctly. Keep it with you at all times by downloading your digital ID card to keep on your smart phone. It is all about convenience. Your digital ID card has the same information that your plastic card will have. In 2023, your membership card will now include your deductible and out of pocket maximums. You will be able to: » View your card on your smartphone, tablet or computer » Email the card to a spouse, child, doctor’s of昀椀ce or pharmacy » Print the card from a smartphone, tablet or computer and use the print out just like a plastic card Accessing your Digital ID Card To access your digital ID card through the My Health Toolkit app you will need to follow these instructions: » Log in to My Health Toolkit. Note » From your mobile device, select Insurance Card. Sign Up for My Health Toolkit at: » From a computer select Insurance Card and then www.MyHealthToolkitLA.com/links/FMOLHS View Your Card. 6

Enrollment All eligible team members must enroll online through Oracle Employee Self Service. Things to Consider Qualifying Life Events Include: Before you enroll, it is a good opportunity for you to Enrollment changes based upon a qualifying life event assess your bene昀椀t needs. must occur within 30 calendar days of that event.* (For » Does your spouse have bene昀椀ts coverage available Example: If you get married on March 1st, you must enroll no later than March 30th.) through another employer? » Did you get married, divorced or have a baby » Change in your FTE status from part-time to full-time or full-time to part-time that results in a recently? If so, do you need to add any dependent(s) signi昀椀cant increase or decrease in your premiums or add your bene昀椀ciary designation? » Did any of your children reach his or her 26th birthday (medical or dental) » Change in your legal marital status (marriage this year? If so, they are not eligible for bene昀椀ts. and divorce) » Change in the number of your dependents (for Your Eligible Dependents for Core example, through birth or adoption, or if a child is Benefits Enrollment no longer an eligible dependent) Dependents eligible for coverage in the FMOLHS Bene昀椀t » Change in your spouse’s employment status Plans include: » Your legal spouse. (resulting in a loss or gain of coverage) » Your dependent children up to age 26 (includes » Change in your employment resulting in a gain or loss of coverage stepchildren, legally-adopted children or children » Entitlement to Medicare or Medicaid* placed with you for adoption, foster children and *If you become eligible for or lose coverage under Medicaid or a state child health plan, grandchildren for whom you have legal custody). you must enroll or terminate coverage within 60 days. » Your dependent child, regardless of age, provided he or she is incapable of self-support due to a mental or physical disability, is fully dependent on you for support as indicated on your federal tax return, and is approved by your Health Plan to continue coverage past age 26. » Please note that veri昀椀cation of eligibility will be required once dependents are enrolled. See page 8 for dependent veri昀椀cation requirements. Note All eligible Team Members must enroll within 30 calendar days of new hire/new eligibility date. 7

Dependent Verification ACCEPTED/REQUIRED VERIFICATION DOCUMENTS DEPENDENT TYPE NATURAL CHILD* Birth Certi昀椀cate; for newborns, birth letter from hospital STEP CHILD* Birth Certi昀椀cate AND veri昀椀cation of current marriage between Team Member (Requires current spouse & child and natural parent (see spouse veri昀椀cation requirements below) veri昀椀cation documents) ADOPTED CHILD/CHILD PLACED Adoption Certi昀椀cate/placement letter from court or adoption agency for FOR ADOPTION* pending adoptions FOSTER CHILD* Proof of Legal Custody, such as a court order GRANDCHILD* Proof of Legal Custody, such as a court order AND copy of current tax return that (Requires 2 documents) identi昀椀es grandchild as a taxable dependent SPOUSE Marriage Certi昀椀cate; AND current or previous year tax return face sheet OR proof of current joint ownership (such as a joint mortgage, joint rental (Requires 2 documents) agreement, joint bank account, joint auto insurance etc.) *Less than age 26 regardless of marital or student status Dependent veri昀椀cation documents for any newly enrolled or previously unveri昀椀ed dependents must be received within 30 calendar days of new hire/new eligibility date in order to maintain dependent coverage. FMOLHS reserves the right to audit dependent veri昀椀cation documents at any time. Note Upload Dependent Veri昀椀cation Documents in Oracle Employee Self Service under Bene昀椀ts/My Documents. 8

How to Enroll in Oracle Employee Self Service 1. Understand Your Choices! The Team Member Guide to Bene昀椀ts Enrollment is available by clicking on My Bene昀椀ts on our Total Rewards page. 2. Review Your Personal Information 3. Enroll Online from Work or Home https://eqtm.login.us2.oraclecloud.com 4. Log in with Your Username and Password a. Click the Me tab b. Click the Bene昀椀ts tile » Note: Before starting your enrollment, be sure to review My Bene昀椀t Resources Card for your bene昀椀t options and important notices c. Click Start Enrollment button 5. Add Your Dependents and Beneficiary(s) a. Be sure to complete all required 昀椀elds for each dependent and bene昀椀ciary b. Upload dependent veri昀椀cation documents to Oracle Employee Self Service under Bene昀椀ts/My Documents. 6. Review Your Dependent Child’s Eligibility for Coverage a. Core Bene昀椀ts (Health, Dental, Vision) – To age 26 regardless of marital or student status. b. Voluntary Life Bene昀椀ts – Unmarried dependent children to age 21; to age 25 if a full time student. c. Voluntary Accident and Critical Illness Bene昀椀ts – To age 26 regardless of marital status or student status. 7. Save and Print Your Elections! If your bene昀椀t elections are properly completed and saved, you will get a con昀椀rmation message on the screen that states, "Your bene昀椀t elections were saved.." If you do not receive a con昀椀rmation message, your elections were not properly completed. You must complete the election process again within 30 days of your new hire/new eligibility date. Go to My Bene昀椀ts card to view and print a copy of your elections. You must have a copy of your 2023 bene昀椀t elections to report a problem with your enrollment. 9

2023 Premium Reduction Opportunities – EPO and PPO Medical Plans Team members are required to complete an annual application to determine eligibility for “Just Premium”. “Just Premium” aligns with our Mission and expands the offer of medical plan premium reductions to team members who apply and qualify for 昀椀nancial assistance based on total household income. Based upon your total household income (adjusted gross income), the number of dependents you claim on your 2021 Federal Income Tax Return, your FTE status (only available to full-time team members), and your hourly rate, you and your family may be eligible for the Just Premium reduction. DEPENDENTS LISTED ON TAX RETURN MAXIMUM HOUSEHOLD INCOME 0 to 1 $34,373 2 $35,482 3 $41,026 4 or more $46,570 Current Maximum Hourly Rate $32.00 Approved team members will receive higher FMOLHS medical plan subsidies to improve affordability and access to coverage. Team Members may select from the EPO or PPO Plans for themselves and their eligible dependents. Please submit a completed application and tax return within 30 calendar days of your new hire/new eligibility date. To apply for Just Premium: » Select My Bene昀椀ts on our Total Rewards and then click on the Just Premium Application link. » Print and complete the application and attach a copy of the 昀椀rst two pages of your 2021 Federal Individual Income Tax Return. If you are married, 昀椀ling jointly, submit one tax return. If you are married, 昀椀ling single or head of household, you will be required to submit the 昀椀rst two pages of both your tax return and your spouse’s return. » Return application/tax return(s) to [email protected] or fax 225-765-9307 within 30 calendar days of your new hire/new eligibility date. Note Individuals who did not 昀椀le a 2021 Income Tax Return will not be eligible for the 2023 Just Premium. 10

My Health Bene昀椀ts Blue Cross Blue Shield www.MyHealthToolkitLA.com/links/fmolhs • 833-468-3594 Health coverage is one of the most important bene昀椀ts FMOLHS can provide. Health bene昀椀ts provide signi昀椀cant value through support for and protection against potentially large 昀椀nancial expenses, as well as covering preventive care. FMOLHS is committed to keeping team members healthy and productive by offering comprehensive health care plans. The option you choose will be in place for all of 2023, unless you have a qualifying life event. Health bene昀椀ts will be administered by Blue Cross Blue Shield. How Do I Find a Provider? FMOLHS has a customized provider directory for its Plan members. To see the current list of the FMOLHS EPO Network or PPO Tier 1 or Tier 2 Network providers online, visit www.MyHealthToolkitLA.com/links/fmolhs. If you do not have access to the website, please call Blue Cross Blue Shield Customer Service at 833-468-3594 for assistance. 11

Navigating Our Network Navigate Our Provider Network the Easy Way STEP 1 FINDING AN IN-NETWORK PROVIDER We understand the importance Whether it be our EPO network or our PPO Tier 1 or NOTE: Always verify a of 昀椀nding a healthcare provider Tier 2 network, our Network Guides can help you: provider’s network status by who can best meet the needs • Find a provider in network calling Blue Cross Blue Shield at of you and your family. We also (833) 468-3594 or by logging understand how daunting it might • Check if a provider you are already seeing is on to MyHealthToolkitLA. be to scroll through a list of doctors in network prior to enrollment com/links/fmolhs. You will in search of the best 昀椀t. That’s why • Assist with scheduling an appointment with have access to the EPO and PPO we offer team members a resource network-based primary care physicians Tier 1 and Tier 2 networks at this to help navigate our FMOLHS site. If the provider address customized network. • Check availability of a specialty service They are called Network Guides, within our network listed on the directory is not and they are available in most Call (855) 875-6265 to connect with a Network Guide the address where care will locations by phone 24/7 for team today. You will be prompted to select a guide for either be delivered, the provider members in both Louisiana and our Louisiana or Mississippi network. may not be in network. Mississippi. Contact BCBS to con昀椀rm. STEP 2 ACCESSING CARE IN OUR NETWORK We offer a variety of ways to connect and access care with an FMOLHS primary care provider. Your PCP is responsible for providing comprehensive care, for having knowledge of your overall medical history, and in assisting you with navigating certain health risks and your healthcare journey. In-Person Video Visits Virtual Extended Hours Visits Same great Avoid urgent care or ER fees and Meet face to care from your meet virtually with a FMOLHS primary All appointment types face with your own provider care provider in our network after are available to schedule provider for from the hours for free with the EPO plan or through MyChart for all wellness checks comfort of your for $5 with the PPO Plan. or appointments home. Available in Louisiana only. ages. that need full We’re working to expand this care evaluations. opportunity to Mississippi. STEP 3 ACCESSING CARE OUTSIDE OUR NETWORK If you need services that are not available Submit all completed requests in NOTE: The network within our EPO or PPO Tier 1 or Tier 2 writing via fax to (803) 264-0259, exception MUST be network, Network Exceptions are available. by email to FMOLHSEXCEPTION@ [email protected] requested and approved To receive an exception, you must complete BCBSSC.COM or by mail to: before services are the Network Exception form on the Total Blue Cross Blue Shield rendered. If the request Rewards My Bene昀椀ts page and have it signed of South Carolina is made after services by your provider. Signed and completed Attn: Network Waiver, AX-630 are rendered, it will not forms must be submitted to BCBS of South PO Box 100300 be considered unless Carolina before services are rendered to be Columbia, SC 29202 otherwise required by law. considered. BCBS SC will notify you of their decision on your request. 12

Road Map to Care Think of your Primary Care Physician (PCP) as your go-to for your health care needs. Your PCP plays an important role in your healthcare journey. Ultimately, building a relationship with your PCP and going to them regularly for illnesses, yearly checkups and screenings can lead to better health outcomes and a higher level of satisfaction with care. In need of a Primary Care Physician? Our Network Guides can help you 昀椀nd a provider. Call now at 855-875-6265. First Stop Primary Care Physician (PCP) Having one doctor who knows your overall health history and can better guide you as you navigate certain health risks leads to better patient experience. There are several ways you can connect and receive care from your in-network PCP, through in-person visits to convenient virtual visits like video or virtual extended hours. See our network navigator page to learn more about each care opportunity available in your area. Second Stop If it's the weekend or it’s later in the evening, Virtual Extended Hours and Urgent Care are good options to consider. Third Stop There are several medical conditions that are considered emergencies because treatment is only available in a hospital setting. 13

Which Plan Is Right for Me — the EPO Plan, PPO Plan or HDHSA Plan? Choosing the most cost-effective health plan is more than just signing up for the one with the lowest paycheck deduction. EPO Plan The EPO Plan provides access to a narrow network of healthcare providers that are either a part of our health system or considered our preferred partners. This means that the plan will allow for eligible medical services as long as you visit a healthcare provider — doctor, hospital or other place offering health care services — within our narrow EPO network. With this plan, the cost shared by you will be lower, whether that is through premiums, copays, deductibles or your out-of-pocket-maximum limit for the year. The plan offers a $250 individual and $500 family deductible and a $0 copay for PCP of昀椀ce visits. Upon enrolling in the EPO Plan, you will gain access to providers who offer high quality care and who are more clinically integrated with our organization’s electronic medical record system, allowing for more comprehensive care. In addition, you can designate a primary care provider (PCP) that can act as your personal health advocate and coordinate your healthcare. It’s important to know that coverage for medical services outside of the EPO network will only be allowed in the event a medical service is needed that is not available within the network. In an emergency, however, eligible services will be covered. This plan may be a better option for those who would like lower deductibles and copays at time of service as well as overall reduced out-of-pocket expense. PPO Plan The PPO health plan design has higher deductibles, coinsurance and copays than the EPO Plan, and continues to offer out-of-network coverage for most services. The pharmacy design copays remain the same including the specialty copays — $100 if 昀椀lled at RxONE and $150 if 昀椀lled by Express Scripts. If you reside outside of Louisiana or Mississippi, you are eligible for out-of-area coverage at the Tier 2 coverage level if you see a BCBS provider in your home state. The out-of-area coverage is based solely upon the employed team member’s address outside of Louisiana or Mississippi. The PPO has higher monthly premiums, but offers out-of- network coverage if needed. This plan choice is bene昀椀cial for those individuals who need out-of-area coverage or need a broader network coverage including out-of-network coverage. HDHSA Plan The HDHSA Plan design has higher deductibles and out-of-pocket maximums along with FMOLHS funding. FMOLHS will provide $750 individual and $1500 family contribution to your HSA account to help with out-of-pocket medical expenses. The deductibles for the HDHSA Plan are $1,750 individual and $3,500 family. If you can take on more 昀椀nancial risk, perhaps you might consider the HDHSA Plan. With a High Deductible Health Plan and a Health Savings Account (HSA), you can save additional pre-tax dollars to pay for medical expenses. You decide how to spend your dollars. Unused HSA dollars roll over from year-to- year. (There are restrictions and limitations to enrollment in the HSA.) 14

Choosing the health plan that is right for you is important. You want to make sure you’re covered for the year ahead, while ensuring you choose the most effective option based on your personal health needs. CONSIDER CONSIDER CONSIDER THE EPO THE PPO THE HDHSA PLAN PLAN PLAN MY HEALTHCARE NEEDS I HAVE A CHRONIC DISEASE, SEE SPECIALIST PHYSICIANS, AND/ OR TAKE SEVERAL BRAND PRESCRIPTION MEDICATIONS. I AM VERY HEALTHY, HAVE NO PLANNED MEDICAL PROCEDURES, TAKE ONE GENERIC PRESCRIPTION MEDICATION AND ONLY HAVE ROUTINE PREVENTIVE CARE. I HAVE A SURGERY SCHEDULED AND CAN USE TIER 1 PROVIDERS. I AM PREGNANT OR PLAN TO BECOME PREGNANT. I HAVE SAVED DOLLARS TO PAY TOWARD MY DEDUCTIBLE AND CAN AFFORD TO PAY THE CO-INSURANCE COSTS OF MY MEDICAL CARE. I HAVE YOUNG CHILDREN WHO ARE OFTEN SICK OR INJURED. I AM LOOKING FOR A HIGH DEDUCTIBLE PLAN THAT ALLOWS ME TO PAY FOR HEALTHCARE EXPENSES WITH DOLLARS I SAVE ONCE I RETIRE. I SEE A PROVIDER THAT IS IN TIER 3 OF THE PPO NETWORK AND WOULD LIKE TO CONTINUE TO SEE THIS PROVIDER EVEN THOUGH MY OUT OF POCKET EXPENSE IS HIGHER. I WORK REMOTELY IN A STATE OTHER THAN LA OR MS AND NEED TO ACCESS CARE FOR MYSELF AND MY FAMILY How Will I Be Billed for a Physician Office Visit? If you are enrolled in the EPO Plan and choose a provider in the EPO network, your primary care visit will be a $0 copay. There is no coverage outside of the EPO network. If you are enrolled in the PPO Plan, your of昀椀ce visit copay pays for your share of the cost of the of昀椀ce visit. When you have additional services, those services are subject to deductible and coinsurance. All services under the HDHSA Plan are subject to deductible and coinsurance. The chart below gives examples of how services would process under the EPO and PPO Plan. IF YOU HAVE: YOU WILL PAY UNDER EPO PLAN: YOU WILL PAY UNDER PPO PLAN: PCP Of昀椀ce Visit No Cost Copay Specialty Of昀椀ce Visit Copay Copay Injections Included with Applicable Of昀椀ce Visit Copay* Deductible & Coinsurance X-rays Included with Applicable Of昀椀ce Visit Copay* Deductible & Coinsurance Lab work Included with Applicable Of昀椀ce Visit Copay* Deductible & Coinsurance *For some services, coinsurance and deductible may apply. 15

How Will I Be Billed for Medical Services? What If a Medical Service or a Claim Is The chart below gives examples of medical services Denied? What Are My Appeal Rights? that require the attention of a physician who may send a When a claim for bene昀椀ts or service denial occurs separate bill for payment. under the FMOLHS Health Plan, the member receives an explanation of bene昀椀ts (EOB) or service denial letter YOU WILL ALSO RECEIVE IF YOU HAVE: A BILL FROM: explaining the reason for the denial. The member has the right to 昀椀le an appeal to request a review of the denial. X-rays The radiologist The appeal should include policy holder name, health Certain lab tests The pathologist plan ID number, patient name, details regarding the Surgery The anesthesiologist & surgeon claim/service being appealed (such as a claim number), Visit by your personal physician Your personal physician and date and provider of service. For full details, please EKG Cardiologist see the Grievances and Appeals Process in the FMOLHS Health Plan Document posted on your facility intranet. Please note for the PPO Plan: If you have a procedure You must 昀椀le an appeal within 180 days after you have performed at an FMOLHS facility, your provider may or been noti昀椀ed of the denial of bene昀椀ts. may not be a FMOLHS Network Tier 1 provider. If the Send requests for review of a denial of bene昀椀ts by provider is not a FMOLHS Network Tier 1 provider, but mail to: is an in-network provider, you will receive a separate bill Blue Cross Blue Shield from the provider for the services performed and the Columbia Service Center provider will be paid at the Tier 2 bene昀椀t level. Attention: Appeals Coordinator AX-830 For example: if you have elected the PPO Plan (80% P.O. Box 100121 FMOLHS Network Tier 1 / 70% Preferred Provider Network Columbia, SC 29202-3121 Tier 2) you would be responsible for 30% of the in-network anesthesiologist’s bill after you have met your deductible. How Do I View My Medical Claims Online? To register for Blue Cross Blue Shield Online Services, after you receive your new medical ID card visit www.MyHealthToolkitLA.com/links/FMOLHS. You will need your medical ID card to register. » Select Register Now » Select Register » Follow the steps given to register www.MyHealthToolKitLA.com/links/FMOLHS allows you to: » View medical claims » View or print explanations of bene昀椀ts » View, request or print an ID card » Find a network provider 16

Health Plan Summaries The charts below give a summary of the 2023 Health Plans for FMOLHS. All covered services are subject to medical necessity as determined by the Plan. All out-of-network services are subject to reasonable and customary (R&C) limitations. EPO Plan The Plan will pay the designated percentage of covered charges if the provider is in the EPO network until out-of-pocket amounts are reached, at which time the Plan will pay 100% of the remainder of covered charges for the rest of the calendar year unless stated otherwise. The following charges do not apply toward the out-of-pocket maximum and are never paid at 100%: deductible(s), cost containment penalties, and above usual and customary charges. There is no out-of-network coverage under the EPO Plan unless otherwise required by law. EPO PLAN FMOLHS EPO NETWORK OUT-OF-NETWORK ANNUAL DEDUCTIBLE EMPLOYEE ONLY $250 No Coverage EMPLOYEE WITH DEPENDENTS $500 No Coverage MAXIMUM OUT-OF-POCKET (INCLUDES DEDUCTIBLE) EMPLOYEE ONLY $2,000 No Coverage EMPLOYEE WITH DEPENDENTS $4,000 No Coverage OFFICE VISIT PRIMARY CARE PHYSICIAN (PCP) $0 copay No Coverage SPECIALIST $35 copay No Coverage EMERGENCY ROOM/URGENT CARE EMERGENCY ROOM $250 copay $250 copay URGENT CARE $60 copay No Coverage OTHER COPAYS OUTPATIENT SURGERY $250 copay No Coverage INPATIENT $200 copay per day (4 day/$800 max) No Coverage PHYSICIAN SERVICES INPATIENT VISITS Included in Inpatient copay No Coverage Included in Of昀椀ce Visit copay, Outpatient Surgery OUTPATIENT copay, or 100% coverage after deductible No Coverage (depending on place of service) HOSPITAL SERVICES ROOM AND BOARD Included in Inpatient copay No Coverage INTENSIVE CARE UNIT Included in Inpatient copay No Coverage OUTPATIENT SURGERY Included in outpatient surgery copay No Coverage SKILLED NURSING FACILITY $200 copay per day (4 day/$800 max) No Coverage BARIATRIC SURGERY Plan Coverage for Bariatric surgery is available only to a Full-Time $3,000 copay; Surgery must be performed or Part-Time Active employee who is a Class A Participant who No Coverage remains in that status on the date of service and satis昀椀es the at a MBSAQIP Accredited FMOLHS facility requirements in Exhibit C and employee’s covered spouse and dependent who satis昀椀es the requirements in Exhibit C. ORGAN TRANSPLANT 90% coverage after deductible when performed No Coverage Blue Distinction Centers coverage only. at Blue Distinction Center facility OTHER SERVICES ALLERGY TESTING 90% coverage after deductible or included in of昀椀ce visit No Coverage copay, depending on place of service ALLERGY SERUM AND INJECTIONS 90% coverage after deductible or included in of昀椀ce visit No Coverage copay, depending on place of service OTHER INJECTIONS 90% coverage after deductible or included in of昀椀ce visit copay, depending on place of service 17

EPO PLAN (CONTINUED) FMOLHS EPO NETWORK OUT-OF-NETWORK OTHER SERVICES 90% coverage after deductible or included in of昀椀ce visit DIAGNOSTICS No Coverage copay, depending on place of service 90% coverage after deductible or included in of昀椀ce visit LABORATORY No Coverage copay, depending on place of service 90% coverage after deductible or included in of昀椀ce visit CHEMOTHERAPY No Coverage copay, depending on place of service 90% coverage after deductible; limited to 50 visits HOME HEALTH CARE No Coverage per calendar year HOSPICE CARE 90% coverage after deductible No Coverage AMBULANCE SERVICE 90% coverage after deductible No Coverage OCCUPATIONAL THERAPY 90% coverage after deductible; maximum of 120 visits PHYSICAL THERAPY per year (and maximum of 20 visits per week) combined No Coverage SPEECH THERAPY Occupational, Physical, and Speech Therapy 90% coverage after deductible maximum of APPLIED BEHAVIOR ANALYSIS (ABA) No Coverage 20 hours per week annually SPECIFIC GENETIC TESTING 90% coverage after deductible drawn/ordered by (MUST SATISFY MEDICALLY NECESSARY CRITERIA) FMOLHS Geneticist No Coverage 100% coverage of screening for tobacco use and two SMOKING CESSATION AIDS tobacco cessation attempts per year which includes four tobacco cessation counseling sessions of at least Smoking cessation is available through the No Coverage 10 minutes each without prior authorization and 90 day prescription bene昀椀t program. supply of Smoking Cessation Aids when prescribed by a health care provider without prior authorization DURABLE MEDICAL EQUIPMENT (DME) 90% coverage after deductible No Coverage INSULIN PUMP 90% coverage after deductible; limited to 1 per 5 years No Coverage ORTHOTICS AND PROSTHETICS 90% coverage after deductible No Coverage GENERIC DIABETES PRESCRIPTION 100% coverage of Generic Diabetes Prescription MEDICATIONS AND SUPPLIES Medications and Preferred Supplies through the No coverage pharmacy bene昀椀t. MENTAL HEALTH AND SUBSTANCE ABUSE INPATIENT INCLUDING PARTIAL HOSPITALIZATION (PHP), INTENSIVE $200 copay per day (4 day/$800 max) No Coverage OUTPATIENT PROGRAM (IOP), AND RESIDENTIAL OFFICE VISIT $0 Copay No Coverage 90% coverage after deductible or included in of昀椀ce visit OTHER OUTPATIENT SERVICES No Coverage copay, depending on place of service PREGNANCY CARE AND DELIVERY LABOR & DELIVERY AND ASSOCIATED CHARGES $200 copay per day (4 day/$800 max) No Coverage 90% coverage after deductible or included in of昀椀ce visit MATERNAL/FETAL ULTRASOUND copay, depending on place of service and other than No Coverage included in prenatal care IN NETWORK BREAST PUMP AND LACTATION COUNSELING THROUGH HEALTHY LIVES 100% coverage No Coverage One-time $50 copay applies for coverage of routine PRE-NATAL CARE OB visits, initial routine labs and one ultrasound No Coverage per term pregnancy. PREVENTIVE CARE ROUTINE WELL ADULT CARE Generally limited to approved preventive or wellness services, which could include the following annual screenings depending 100% coverage on your age, gender, and health status: Lipid (Cholesterol), HGB Limited to one routine physical examination No Coverage A1C (Diabetes), Bone Marrow Density Test, Mammogram, Pap annually and approved wellness screenings annually Test, Fecal Occult Blood Test, Colonoscopy, Depression Screening, Obesity Screening and Counseling. *Please call the Claims Administrator to con昀椀rm coverage ADULT IMMUNIZATIONS 100% coverage No Coverage Immunizations are subject to current CDC Recommendations which include age limitations ROUTINE WELL CHILD CARE Unlimited routine of昀椀ce visits through age two (2); annually ages 100% coverage No Coverage three (3) up. Includes: of昀椀ce visits, routine physical examination and immunizations in accordance with CDC Guidelines and preventive care in accordance with federal guidelines. *FMOLHS follows federal guidelines for coverage of preventive/wellness screenings. 18

PPO Plan The Plan will pay the designated percentage of covered charges until out-of-pocket amounts are reached, at which time the Plan will pay 100% of the remainder of covered charges for the rest of the calendar year unless stated otherwise. The following charges do not apply toward the out-of-pocket maximum and are never paid at 100%: deductible(s), cost containment penalties, and above usual and customary charges. PPO PLAN FMOLHS NETWORK PREFERRED PROVIDER NON-PREFERRED OUT-OF-NETWORK (TIER 1) NETWORK (TIER 2) PROVIDER (TIER 3) ANNUAL DEDUCTIBLE EMPLOYEE ONLY $800 $800 $3,000 $5,000 EMPLOYEE WITH DEPENDENTS $1,600 $1,600 $6,000 $10,000 MAXIMUM OUT-OF-POCKET (INCLUDES DEDUCTIBLE) EMPLOYEE ONLY $3,000 $4,000 $6,000 $10,000 EMPLOYEE WITH DEPENDENTS $6,000 $8,000 $12,000 $20,000 Out of Area Coverage. A subscriber (team member) who is enrolled in the PPO Plan and whose home address is in a state other than Louisiana or Mississippi may (i) access care at Tier 2 network coverage with a BCBS PPO network provider in their home state for themselves and their enrolled dependents or (ii) access providers in the FMOLHS Louisiana and Mississippi networks at Tier 1 or Tier 2 coverage. Any other network access would follow the Tier 3 or Out-of-Network coverage. The Out of Area Coverage is based solely on the subscriber’s (team member’s) home address. A dependent’s address does not entitle the dependent to Out of Area Coverage. OFFICE VISIT $5 copay of昀椀ce visit only, $30 copay of昀椀ce visit only, PCP/MEDICAL HOME all other services subject to all other services subject to deductible and coinsurance deductible and coinsurance 60% coverage 40% coverage after deductible after deductible $45 copay of昀椀ce visit only, $70 copay of昀椀ce visit only, SPECIALIST all other services subject to all other services subject to deductible and coinsurance deductible and coinsurance EMERGENCY ROOM/URGENT CARE EMERGENCY ROOM 80% coverage after deductible URGENT CARE $75 copay $75 copay 60% coverage after deductible 40% coverage PHYSICIAN SERVICES INPATIENT VISITS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible OUTPATIENT 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible HOSPITAL SERVICES ROOM AND BOARD 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible INTENSIVE CARE UNIT 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible SURGERY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible SKILLED NURSING FACILITY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible BARIATRIC SURGERY Plan Coverage for Bariatric surgery is available only to a Full-Time or Part-Time Active $3,000 copay; Surgery must employee who is a Class A Participant who be performed at a MBSAQIP No coverage No coverage No coverage remains in that status on the date of service Accredited FMOLHS facility and satis昀椀es the requirements in Exhibit C and employee’s covered spouse and dependent who satis昀椀es the requirements in Exhibit C ORGAN TRANSPLANT 80% coverage after deductible No coverage Blue Distinction Centers coverage only. when performed at Blue Distinction Center facility OTHER SERVICES ALLERGY TESTING 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible ALLERGY SERUM AND INJECTIONS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible OTHER INJECTIONS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible DIAGNOSTICS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible LABORATORY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible CHEMOTHERAPY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible 80% coverage after deductible; 70% coverage after deductible; 60% coverage after deductible; HOME HEALTH CARE maximum of 50 visits per maximum of 50 visits per maximum of 50 visits per No coverage calendar year calendar year calendar year HOSPICE CARE 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible AMBULANCE SERVICE 80% coverage after deductible 19

PPO PLAN (CONTINUED) FMOLHS NETWORK PREFERRED PROVIDER NON-PREFERRED OUT-OF-NETWORK (TIER 1) NETWORK (TIER 2) PROVIDER (TIER 3) OTHER SERVICES OCCUPATIONAL THERAPY 80% coverage after deductible; 70% coverage after deductible 60% coverage after deductible PHYSICAL THERAPY No coverage SPEECH THERAPY Maximum of 120 visits per year (and maximum of 20 visits per week) combined with Occupational, Physical, and Speech Therapy 70% coverage after deductible; 80% coverage after deductible; 60% coverage after deductible; APPLIED BEHAVIOR ANALYSIS (ABA) No coverage max 20 hours per week annually max 20 hours per week annually max 20 hours per week annually SPECIFIC GENETIC TESTING 80%; drawn/ordered by (MUST SATISFY MEDICALLY NECESSARY No coverage No coverage No coverage CRITERIA) FMOLHS Geneticist SMOKING CESSATION AID 100% coverage of screening for tobacco use and two tobacco cessation attempts per year which includes four tobacco cessation counseling sessions of at least 10 minutes each without prior authorization and No coverage Smoking cessation is available through the 90 day supply of Smoking Cessation Aids when prescribed by a health care provider without prior prescription bene昀椀t program authorization DURABLE MEDICAL EQUIPMENT (DME) 80% coverage after deductible; 70% coverage after deductible 60% coverage after deductible No coverage 80% coverage after deductible; 70% coverage after deductible; 60% coverage after deductible; INSULIN PUMP No coverage limited to 1 per 5 years limited to 1 per 5 years limited to 1 per 5 years ORTHOTICS AND PROSTHETICS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible GENERIC DIABETES 100% coverage of Generic Diabetes Prescription Medications PRESCRIPTION MEDICATIONS No coverage No coverage AND PREFERRED SUPPLIES and Preferred Supplies through the pharmacy bene昀椀t MENTAL/NERVOUS AND SUBSTANCE ABUSE INPATIENT Including Partial Hospitalization (PHP), 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible Intensive Outpatient Program (IOP) and Residential OFFICE VISIT ONLY $5 copay $30 copay 60% coverage after deductible 40% coverage after deductible OTHER OUTPATIENT SERVICES 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible PREGNANCY CARE AND DELIVERY LABOR & DELIVERY AND ASSOCIATED CHARGES 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible 80% coverage after deductible; 70% coverage after deductible; 60% coverage after deductible; MATERNAL/FETAL ULTRASOUND other than included in other than included in other than included in 40% coverage after deductible pre-natal care pre-natal care pre-natal care IN NETWORK BREAST PUMP AND LACTATION COUNSELING 100% coverage 100% coverage 100% coverage No coverage THROUGH HEALTHY LIVES One time $50 copay applies to routine OB visits, initial routine labs and PRE-NATAL CARE 40% coverage after deductible one ultrasound per term pregnancy. PREVENTATIVE CARE ROUTINE WELL ADULT CARE Generally limited to approved preventive or wellness services, which could include the 40% coverage 100% coverage 100% coverage 100% coverage following annual screenings depending on after deductible; Limited to one routine physical Limited to one routine physical Limited to one routine physical your age, gender, and health status: Lipid Limited to one routine physical examination annually and examination annually and examination annually and (Cholesterol), HGB A1C (Diabetes), Bone examination annually and Marrow Density Test, Mammogram, Pap approved wellness screenings approved wellness screenings approved wellness screenings approved wellness screenings Test, Fecal Occult Blood Test, Colonoscopy, annually. annually. annually. annually. Depression Screening, Obesity Screening and Counseling.* Please call the Claims Administrator to con昀椀rm coverage ADULT IMMUNIZATIONS Immunizations are subject to current CDC 100% coverage 100% coverage 100% coverage 40% coverage after deductible Recommendations which include age limitations ROUTINE WELL CHILD CARE Unlimited routine of昀椀ce visits through age two (2); annually ages three (3) up. Includes: 100% coverage 100% coverage 100% coverage 40% coverage after deductible of昀椀ce visits, routine physical examination and immunizations in accordance with CDC Guidelines and preventive care in accordance with federal guidelines. *FMOLHS follows federal guidelines for coverage of preventive wellness screenings. 20

HDHSA HDHSA Plan – A high deductible health plan with a tax-free health savings account (HSA). You determine how much you’ll contribute to the account, when to use the money to pay for quali昀椀ed medical, prescription, dental and vision services, and when to reimburse yourself. HSAs allow you to save and roll over money if you do not spend it in the calendar year. The money in this account is portable, even if you change plans or jobs. Company HSA contributions will be pro-rated based on enrollment date. You cannot open an HSA if: » You have other health coverage that helps you pay » You also have Medicare or TRICARE. for health care expenses before your deductible » Someone else can claim you as a dependent. is met. » You have used Veterans Affairs hospital or medical » You or your spouse has a 昀氀exible spending account services in the three months prior to opening your (FSA) or health reimbursement arrangement (HRA). HSA, unless it was for a disability related to your (You are allowed to participate in a Limited Use FSA, military service. which would only cover Dental and Vision expenses.) HIGH DEDUCTIBLE HSA PLAN FMOLHS NETWORK PREFERRED PROVIDER NON-PREFERRED OUT-OF-NETWORK (TIER 1) NETWORK (TIER 2) PROVIDER (TIER 3) HSA ANNUAL CONTRIBUTIONS EMPLOYEE ONLY $750 EMPLOYEE WITH DEPENDENTS $1,500 ANNUAL DEDUCTIBLE (AGGREGATED) EMPLOYEE ONLY $1,750 $1,750 $3,500 $4,000 EMPLOYEE WITH DEPENDENTS $3,500 $3,500 $7,000 $8,000 MAXIMUM OUT-OF-POCKET (INCLUDES DEDUCTIBLE) (EMBEDDED OOP) EMPLOYEE ONLY $3,500 $4,000 $7,000 $10,500 EMPLOYEE WITH DEPENDENTS $7,000 $8,000 $14,000 $21,000 The Out of Area coverage is not available under the High Deductible HSA Plan. OFFICE VISIT CHARGE ONLY PRIMARY CARE PHYSICIAN (PCP) 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible SPECIALIST 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible EMERGENCY ROOM/URGENT CARE EMERGENCY ROOM 80% coverage after deductible 80% coverage after deductible 80% coverage after deductible 80% coverage after deductible URGENT CARE 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible PHYSICIAN SERVICES INPATIENT VISITS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible OUTPATIENT 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible HOSPITAL SERVICES ROOM AND BOARD 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible INTENSIVE CARE UNIT 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible SURGERY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible SKILLED NURSING FACILITY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible 21

HDHSA PLAN (CONTINUED) FMOLHS NETWORK PREFERRED PROVIDER NON-PREFERRED OUT-OF-NETWORK (TIER 1) NETWORK (TIER 2) PROVIDER (TIER 3) HOSPITAL SERVICES BARIATRIC SURGERY Plan Coverage for Bariatric surgery is available only to a Full-Time or Part-Time Active $3,000 copay; Surgery must employee who is a Class A Participant who be performed at a MBSAQIP No coverage No coverage No coverage remains in that status on the date of service Accredited FMOLHS facility and satis昀椀es the requirements in Exhibit C and employee’s covered spouse and dependent who satis昀椀es the requirements in Exhibit C ORGAN TRANSPLANT 80% coverage after deductible No coverage Blue Distinction Centers coverage only when performed at Blue Distinction Center facility OTHER SERVICES ALLERGY TESTING 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible ALLERGY SERUM AND INJECTIONS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible OTHER INJECTIONS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible DIAGNOSTICS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible LABORATORY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible CHEMOTHERAPY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible 80% coverage after deductible; 70% coverage after deductible; 60% coverage after deductible; HOME HEALTH CARE maximum of 50 visits per maximum of 50 visits per maximum of 50 visits per No coverage calendar year calendar year calendar year HOSPICE CARE 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible AMBULANCE SERVICE 80% coverage after deductible OCCUPATIONAL THERAPY 80% coverage after deductible; 70% coverage after deductible 60% coverage after deductible PHYSICAL THERAPY No coverage SPEECH THERAPY Maximum of 120 visits per year (and maximum of 20 visits per week) combined with Occupational, Physical, and Speech Therapy 70% coverage after deductible; 80% coverage after deductible; 60% coverage after deductible; APPLIED BEHAVIOR ANALYSIS (ABA) No coverage max 20 hours per week annually max 20 hours per week annually max 20 hours per week annually SPECIFIC GENETIC TESTING 80%; drawn/ordered by (MUST SATISFY MEDICALLY NECESSARY No coverage No coverage No coverage CRITERIA) FMOLHS Geneticist SMOKING CESSATION AID 100% coverage of screening for tobacco use and two tobacco cessation attempts per year which includes four tobacco cessation counseling sessions of at least 10 minutes each without prior authorization and No coverage Smoking cessation is available through the 90 day supply of Smoking Cessation Aids when prescribed by a health care provider without prior prescription bene昀椀t program authorization DURABLE MEDICAL EQUIPMENT (DME) 80% coverage after deductible; 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible 80% coverage after deductible; 70% coverage after deductible; 60% coverage after deductible; INSULIN PUMP No coverage limited to 1 per 5 years limited to 1 per 5 years limited to 1 per 5 years ORTHOTICS AND PROSTHETICS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible GENERIC DIABETES PRESCRIPTION MEDICATIONS 100% coverage of Generic Diabetes Prescription Medications No coverage No coverage AND PREFERRED SUPPLIES and Preferred Supplies through the pharmacy bene昀椀t Employee must satisfy deductible MENTAL/NERVOUS AND SUBSTANCE ABUSE INPATIENT Including Partial Hospitalization (PHP), 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible Intensive Outpatient Program (IOP) and Residential OFFICE VISIT ONLY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible OTHER OUTPATIENT SERVICES 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible PREGNANCY CARE AND DELIVERY LABOR & DELIVERY AND ASSOCIATED CHARGES 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible MATERNAL/FETAL ULTRASOUND 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible 22

HDHSA PLAN (CONTINUED) FMOLHS NETWORK PREFERRED PROVIDER NON-PREFERRED OUT-OF-NETWORK (TIER 1) NETWORK (TIER 2) PROVIDER (TIER 3) PREGNANCY CARE AND DELIVERY IN-NETWORK BREAST PUMP AND LACTATION COUNSELING 100% coverage 100% coverage 100% coverage No coverage THROUGH HEALTHY LIVES PRE-NATAL CARE 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible PREVENTATIVE CARE ROUTINE WELL ADULT CARE Generally limited to approved preventive or wellness services, which could include the 40% coverage 100% coverage 100% coverage 100% coverage following annual screenings depending on after deductible; Limited to one routine physical Limited to one routine physical Limited to one routine physical your age, gender, and health status: Lipid Limited to one routine physical examination annually and examination annually and examination annually and (Cholesterol), HGB A1C (Diabetes), Bone examination annually and Marrow Density Test, Mammogram, Pap approved wellness screenings approved wellness screenings approved wellness screenings approved wellness screenings Test, Fecal Occult Blood Test, Colonoscopy, annually. annually. annually. annually. Depression Screening, Obesity Screening and Counseling. *Please call the Claims Administrator to con昀椀rm coverage ADULT IMMUNIZATIONS Immunizations are subject to current CDC 100% coverage 100% coverage 100% coverage 40% coverage after deductible Recommendations which include age limitations ROUTINE WELL CHILD CARE Unlimited routine of昀椀ce visits through age two (2); annually ages three (3) up. Includes: 100% coverage 100% coverage 100% coverage 40% coverage after deductible of昀椀ce visits, routine physical examination and immunizations in accordance with CDC Guidelines and preventive care in accordance with federal guidelines. *FMOLHS follows federal guidelines for coverage of preventive wellness screenings. Note When you enroll in the HSA plan, PayFlex will provide you with a debit card that includes the FMOLHS annual contribution to help pay for eligible expenses. 23

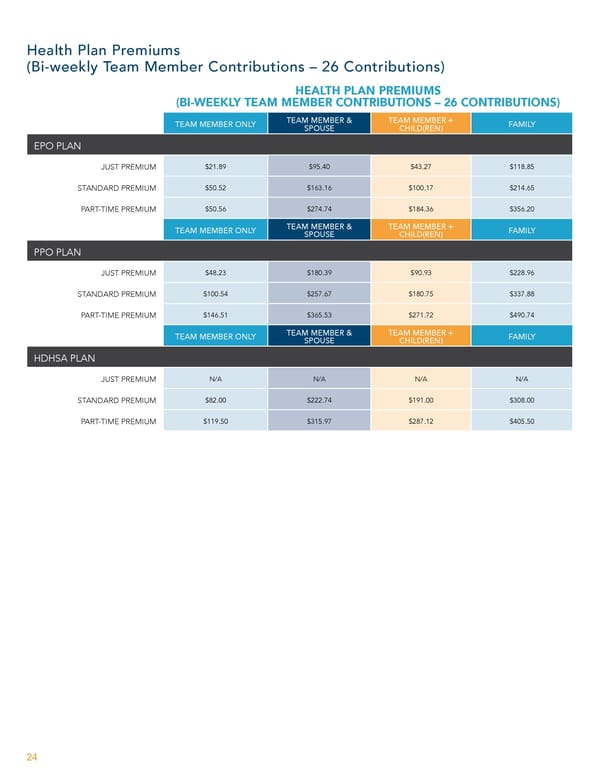

Health Plan Premiums (Bi-weekly Team Member Contributions – 26 Contributions) HEALTH PLAN PREMIUMS (BI-WEEKLY TEAM MEMBER CONTRIBUTIONS – 26 CONTRIBUTIONS) TEAM MEMBER & TEAM MEMBER + TEAM MEMBER ONLY FAMILY SPOUSE CHILD(REN) EPO PLAN JUST PREMIUM $21.89 $95.40 $43.27 $118.85 STANDARD PREMIUM $50.52 $163.16 $100.17 $214.65 PART-TIME PREMIUM $50.56 $274.74 $184.36 $356.20 TEAM MEMBER & TEAM MEMBER + TEAM MEMBER ONLY FAMILY SPOUSE CHILD(REN) PPO PLAN JUST PREMIUM $48.23 $180.39 $90.93 $228.96 STANDARD PREMIUM $100.54 $257.67 $180.75 $337.88 PART-TIME PREMIUM $146.51 $365.53 $271.72 $490.74 TEAM MEMBER & TEAM MEMBER + TEAM MEMBER ONLY FAMILY SPOUSE CHILD(REN) HDHSA PLAN JUST PREMIUM N/A N/A N/A N/A STANDARD PREMIUM $82.00 $222.74 $191.00 $308.00 PART-TIME PREMIUM $119.50 $315.97 $287.12 $405.50 24

This is a modal window.

My Pharmacy Bene昀椀ts Express Scripts (ESI) • www.express-scripts.com • 877-816-8717 Prescription Drug Coverage for Medical Plans Your prescription drug program will be coordinated through Express Scripts (ESI). Your cost is determined by the tier assigned to the prescription drug product. All prescription drug products on the prescription drug list (Express Scripts' National Preferred Formulary) are assigned as Generic, Preferred, Non-Preferred and Specialty. You may contact ESI for information on your bene昀椀t coverage and search for network pharmacies by logging on to www.express-scripts.com or calling ESI Customer Care at 877-816-8717. Why Do My Prescriptions Cost So Much? In recent years, drug costs have increased, outpacing in昀氀ation by nearly four times annually. Rising drug costs are one of the single largest causes of the ballooning cost of health care. Although rising drug costs are inevitable, there are many ways you, the patient, with the help of your physician, can minimize your prescription drug costs while maintaining the same quality of health. You share the cost of your medications with your employer. Your share of the cost is called a copay or coinsurance. Some plans offer lower copays for less costly drugs. For example, they charge one copay for a Generic drug, a higher copay for a Preferred drug, and an even higher copay for a Non-Preferred drug. Coinsurance is a percent of the drug’s cost. When you pay a percentage, your cost may be high for many reasons: » The cost of the drug may be high. Let’s assume your coinsurance is 20%. In this case, a $250 drug will be more costly than a $25 drug. » Your drug may not be on the Preferred Drug List, so you pay at a higher tier. » You may be buying a more expensive brand-name drug when there is a generic equivalent available for less money. How Can I Minimize My Medication Costs? » Consider Mail Order for your maintenance medications. You receive a 3-month supply for only two copays if you 昀椀ll your prescription at RxONE. Example: EPO PLAN ANNUAL COST PRESCRIPTION GENERIC – IN-HOUSE $10 per month $120 GENERIC – MAIL ORDER $20 per 3 months $80 YOUR ANNUAL SAVINGS N/A $40 » You can explore the bene昀椀ts available to you before enrolling by visiting https://www.express-scripts.com/fmolhs. Here you can review plan options, 昀椀nd prices on medications under the plan, and explore an overview of the bene昀椀ts offered. » Print a copy of the Express Scripts National Preferred formulary and bring it with you when you visit your physician. Log on to www.express-scripts.com, and click on Register. Once you complete the registration you will have access to your account information, bene昀椀ts and formulary list. » Let your physician know that you would like to try generics 昀椀rst, if that is an appropriate option for you. » Ask your provider if there are Over-the-Counter (OTC) products available to obtain the same results as prescription medications. Often these OTC products will be less expensive than your copay and will provide the same relief. » Get a $5 discount when you 昀椀ll your prescription at an in-house pharmacy. Get an additional $5 discount when your prescription is written by the Franciscan Clinic and 昀椀lled at the in-house pharmacy. Refer to page 27 for a listing of the in-house pharmacy locations/services. 25

EPO PRESCRIPTION PLAN COST IN-HOUSE NETWORK RETAIL PHARMACY (30-DAY SUPPLY) GENERIC DRUG $10 copay $15 copay GENERIC DIABETIC PRESCRIPTION MEDICATIONS AND SUPPLIES $0 copay $0 copay PREFERRED DRUG $35 copay $70 copay NON-PREFERRED DRUG $70 copay $110 copay SPECIALTY DRUG Filled by RxONE – $100 copay Filled by Express Scripts – $150 copay MAIL ORDER PHARMACY (90-DAY SUPPLY — RXONE OR EXPRESS SCRIPTS) GENERIC DRUG PREFERRED DRUG 2x in-house copay* 3x network copay* NON-PREFERRED DRUG BRAND-NAME DRUGS WHEN GENERIC IS AVAILABLE The brand copayment, plus the difference between the retail cost of the brand-name drug and of the generic drug. Note: The difference will not be applied to the out-of-pocket maximum. IMMUNIZATIONS According to CDC Immunization Schedules; Subject to age limitations *Mail order copays do not apply to mail order Specialty Prescriptions. PPO PRESCRIPTION PLAN COST IN-HOUSE NETWORK RETAIL PHARMACY (30-DAY SUPPLY) GENERIC DRUG $10 copay $15 copay GENERIC DIABETIC PRESCRIPTION MEDICATIONS AND SUPPLIES $0 copay $0 copay PREFERRED DRUG $45 copay $70 copay NON-PREFERRED DRUG $70 copay $110 copay SPECIALTY DRUG Filled by RxONE – $100 copay Filled by Express Scripts – $150 copay MAIL ORDER PHARMACY (90-DAY SUPPLY – RXONE OR EXPRESS SCRIPTS) GENERIC DRUG PREFERRED DRUG 2x In-house copay* 3x Network copay* NON-PREFERRED DRUG BRAND-NAME DRUGS WHEN GENERIC IS AVAILABLE The brand copayment, plus the difference between the retail cost of the brand-name drug and of the generic drug. Note: The difference will not be applied to the out-of-pocket maximum. IMMUNIZATIONS According to CDC Immunization Schedules; Subject to age limitations *Mail order copays do not apply to mail order Specialty Prescriptions. 26

HDHSA PRESCRIPTION PLAN COST IN-HOUSE NETWORK RETAIL PHARMACY (30-DAY SUPPLY) GENERIC DRUG 20% after deductible 20% after deductible GENERIC DIABETIC PRESCRIPTION MEDICATIONS AND SUPPLIES 20% after deductible 20% after deductible PREFERRED DRUG 20% after deductible 20% after deductible NON-PREFERRED DRUG 20% after deductible 20% after deductible SPECIALTY DRUG (RXONE OR EXPRESS SCRIPTS) 20% after deductible 20% after deductible MAIL ORDER PHARMACY (90-DAY SUPPLY — RXONE OR EXPRESS SCRIPTS) GENERIC DRUG PREFERRED DRUG 20% after deductible NON-PREFERRED DRUG BRAND-NAME DRUGS WHEN GENERIC IS AVAILABLE The brand copayment, plus the difference between the retail cost of the brand-name drug and of the generic drug. Note: The difference will not be applied to the out-of-pocket maximum. IMMUNIZATIONS According to CDC Immunization Schedules; Subject to age limitations *Mail order copays do not apply to mail order Specialty Prescriptions. IN-HOUSE PHARMACY OVERVIEW SERVICES SERVICE PHARMACY LOCATION EMPLOYEE AREA FLAVOR- MAIL IMMUNI- RETAIL SPECIALTY DELIVERY HEALTHPLAN ING ORDER ZATIONS DISCOUNT * 1014 West St. Claire Blvd Ste. 1010 RxONE | Ascension LA 225-271-6098 7777 Hennessy Blvd Ste 114, BR RxONE | Med Plaza LA 225-765-8951 5000 Hennessy, Chapel Hallway Rm 101, BR RxONE| Lake LA 225-374-0260 2600 Tower Dr., Monroe RxONE | Tower Drive LA 318-966-6290 309 Jackson St, Monroe RxONE | St Francis LA & MS MS only 318-966-7242 4809 Ambassador Caffery Pkwy, Laf RxONE | Lourdes 337-470-4342 LA & MS MS only 5131 O’Donovan Dr, BR O'Donovan Pharmacy 225-374-0270 LA 1401 N. Foster Dr, BR Mid City Pharmacy LA 225-987-9184 8300 Constantin Blvd, BR Lake Children's Pharmacy LA 225-374-1350 433 Plaza St., Bogalusa, LA Our Lady of the Angel OP LA 985-730-7219 27

Preauthorization Requirement List Note: The following services, supplies and care must be preauthorized or reimbursement from the Plan may be reduced. To preauthorize services, your provider can contact Blue Cross Blue Shield at 833-468-3594. If preauthorization requirements are not met, covered expenses will be paid at 50% if the services are Medically Necessary and 0% if the services are not Medically Necessary. If you have any questions regarding medical preauthorization, call Blue Cross Blue Shield at 833-468-3594. » All Inpatient Admissions (Includes acute, Skilled, » Growth Hormones Rehabilitation, LTAC and Treatment Room Services) » Home Health » All Clinical Trials, Experimental & Investigational » Hyperbaric Oxygen Therapy Procedures/Treatment » Injectables (Boniva, Reclast, Hyalgan, Synagis, » All Transplant Services Including Pre-Transplant Orthovisc, Supartz, Botox, & Growth Hormones) Evaluations » Insulin Pump » All Out-of-Network and Out-of-Area Services, except » IV Infusions inpatient admissions, outpatient services, residential » Mental Health Services treatment, home health and hospice » All Plastic & Reconstructive Surgeries & Procedures » Orthotics and Prosthetics over $1,000 (with the exception of fracture or sprain diagnosis) (Cosmetic procedures are excluded from coverage) » All CT Scans and MRIs including CTAs and MRAs » PET Scans » 17 Alpha-Hydroxyprogesterone Caproate (17P) » Pain Management procedures » Alcohol/Substance Abuse » Podiatry treatment » Applied Behavior Analysis » Diagnostic studies and/or treatment of Sleep » Bariatric Surgery Disorders » Diabetic Education » Surgery (hysterectomy, varicose vein, nasal/septal » Durable Medical Equipment (purchases over $500 surgery, breast reduction, surgical intervention to correct sleep apnea, oral surgery) and all rentals) » Therapies – Physical, Speech, Occupational » Enteral Feedings » Non-Emergent Air Ambulance and Non-Emergent » Epidural Steroid Injections Ambulance Transportation » Genetic Studies/Testing/Therapy » Weight Loss Program & Medications (This list is not inclusive of all codes requiring prior authorizations; please contact Member Services for bene昀椀ts, eligibility, and code speci昀椀c requirements at 833-468-3594.) 28

Which Preventive Services Can I Get With No Out-of-Pocket Expenses? Depending on your age, you may have access at reduced or no cost to such preventive services as: » One adult routine preventive care visit annually: » Blood pressure, diabetes, and cholesterol tests; » Screening tests for many common types of cancers, including mammograms and colonoscopies (the test used to screen for colon cancer) in accordance with U.S. Preventive Services Task Force (USPSTF) recommendations; » Counseling from your health care provider on such topics as quitting smoking, losing weight, eating healthy, treating depression, and reducing alcohol use; » Routine vaccinations against disease, such as measles, polio, meningitis, 昀氀u and pneumonia shots in accordance with CDC recommendations; » Counseling, screening, and vaccines to ensure healthy pregnancies; and » Regular well-baby and well child visits from birth to age 21. Screening in these areas (blood pressure, cholesterol, glucose, obesity) can be completed by scheduling your annual well visit with your Primacy Care Provider. Note For a complete list of affected preventive services, go to www.healthcare.gov/coverage/preventive-care-bene昀椀ts/ 29

2023 ADULT PREVENTIVE SERVICE RECOMMENDATIONS¹ THIS CHART IS INTENDED AS A REFERENCE TOOL FOR YOUR CONVENIENCE. AGE 21-39 40-49 50-64 65 or older PREVENTION/SCREENING One time screening by ABDOMINAL AORTIC ANEURYSM SCREENING ultrasonography in men ages 65-75 who have ever smoked BREAST CANCER SCREENING As recommended Screening mammography, every year, for by your health care women age 40 years and older, with or without (BRCA²; MEDICATION³) provider* clinical breast examination Cytology (Pap smear) every 3 years women ages 21 – 65 or As recommended CERVICAL CANCER SCREENING by your health care Ages 30 – 65 years who want to lengthen the interval, screening with a provider* combination of cytology & human papillomavirus (HPV) testing every 5 yrs. Men ages 20 – 35 for lipid disorders if they are at increased risk for CHOLESTEROL ABNORMALITIES SCREENING: MEN coronary heart disease Men ages 35 and older for lipid disorders Women ages 30 – 45 years for lipid disorders if they CHOLESTEROL ABNORMALITIES are at increased risk for coronary heart disease SCREENING: WOMEN Women age 45 years and older for lipid disorders As recommended by your Adults beginning at age 45, fecal occult blood COLORECTAL CANCER SCREENING testing annually, sigmoidoscopy every 5 years, or health care provider* colonoscopy every 10 years DIABETES SCREENING Beginning at age 45 (If you have high blood pressure or high cholesterol, are overweight, or have a close family history of diabetes, you should consider an earlier screening.) HEPATITIS C SCREENING Adults age 18 – 79 without known liver disease, a one-time screening for hepatitis C virus (HCV) 4 IMMUNIZATIONS Refer to the CDC’s posted schedule of immunizations LUNG CANCER SCREENING Annual screening with low-dose computed Screening should be discontinued once a person has not tomography in adults age 50 – 80 years who have a smoked for 15 years or develops a health problem that substantially limits life expectancy or the ability or 20 pack-year smoking history and currently smoke or have quit within the past 15 years. willingness to have curative lung surgery OSTEOPOROSIS SCREENING Bone density in younger women whose fracture risk is equal to or greater than Bone density for women that of a 65 year old white woman who has no additional risk factors. age 65 years or older WELLNESS OFFICE VISIT: PHYSICAL EXAM, BLOOD PRESSURE, BODY MASS INDEX (BMI) Annually * High Risk: There is no age limit for screening if you are at high risk: Colon cancer: If you or a close relative had colorectal polyps or colorectal cancer or if you have in昀氀ammatory bowel disease. Breast cancer: This might include women who carry genes that increase their risk of breast cancer, such as the “BRCA” genes or who have close relatives who were diagnosed with breast cancer at a young age. ¹ https://www.uspreventiveservicestaskforce.org/uspstf/recommendation-topics (current as of June 2022) ² BRCA risk assessment and genetic counseling/testing: Screen women whose family history may be associated with an increased risk for potentially harmful BRCA mutations. Women with positive screening results should receive genetic counseling and, if indicated after counseling, BRCA testing. ³ Breast cancer preventive medications: Asymptomatic women aged ≥35 years without a prior diagnosis of breast cancer who are at increased risk for the disease. Clinicians engage in shared, informed decision making with women who are at increased risk for breast cancer about medications to reduce their risk. 4 Adult immunizations: https://www.cdc.gov/vaccines/schedules/index.html Additional preventive care bene昀椀ts may be covered under the health plan. 30

Care Management In partnership with your primary care provider, you have access to additional resources to meet your health goals. A care team will work closely with physicians to provide the care needed for individuals with chronic diseases such as diabetes, high blood pressure, heart failure and asthma. The entire care team will work together to provide seamless care, will help individuals navigate the health care system and get connected with the resources needed to better manage their disease. Below are a couple of the focus areas and the bene昀椀ts available for health plan members who qualify: Transition Care Targets patients who are discharged from the hospital and have previously been identi昀椀ed as having a high likelihood of readmission within 30 days. Complex Care Targets patients who are living with complex chronic conditions, such as hypertension and diabetes, and are at high risk for either an emergency or inpatient encounter. Diabetes Management Program Disease management is a con昀椀dential program provided by FMOLHS to help you or a covered dependent living with a chronic condition. Diabetes coaching is available through Healthy Lives. Eligible team members and dependents will have access to a personal health coach and together develop achievable goals and strategies for improving their overall health. When you work with a nurse coach, you’ll get tips and practical tools for managing your chronic condition. They will also help you set up a plan to reach personal goals. Coaching is a great way to re-energize yourself to improve or manage your condition. Maternity Management In partnership with your health care provider, a Healthy Lives registered nurse will assist you throughout your pregnancy with your personalized health needs. Maternity management nurses will have personal contact each trimester and provide 昀椀rst year of life education. Individuals engaged in maternity management receive free preconception counseling and prenatal information. 31

My Health and Well-Being To participate in the 2023 Health and Wellness Program My Health and Well-being Program Now more than ever we recognize the importance and to begin earning points, follow the steps below: 1. Complete your HRA Questionnaire on the Healthy of offering opportunities to care for your health and Lives app or web-based portal. well-being. Our well-being program provides you with a more streamlined and personalized program and gives 2. Schedule and complete your wellness visit with you more opportunities to engage and get rewarded for your PCP between December 16, 2022 and participating in health and well-being activities. December 15, 2023. During your wellness visit, your PCP will perform your annual wellness exam Your primary care physician (PCP) should be your main point and your biometric screening. of contact in your wellness journey. You’ll have to complete this PCP visit along with completing the HRA questionnaire – NOTE: Contact our Network Guides at to be eligible for rewards under the well-being program. 855-875-6265 if you need assistance 昀椀nding Each point you earn equals $1 in rewards. Team members a primary care provider or scheduling an can earn up to 550 points or $550 in rewards.* appointment. You have many options on how to redeem points that you 3. Engage in approved activities that help you achieve earn. We have partnered with a company called Awardco, your goals and earn your rewards. which will enable you to redeem your wellness points – There is a catalog of approved activities available on things such as Amazon items, hotels, virtual pre-paid on the Total Rewards site on the My Health and cards, e-gift cards, movie tickets, or cash the rewards Well-being page or on the Healthy Lives portal. out for additional money on your paycheck. The choice is yours! Earned points will be available for redemption Review the activities and determine which best 昀椀t with your work-life schedule and complete the on the 15th of each month. activities. Then follow the steps to con昀椀rm your participation in the activities. 4. Redeem your points for rewards of your choice on the Awardco site, which can be accessed through the Healthy Lives portal or online at https://fmolhs.awardco.com. You will need to register on the Awardco site to access your rewards. *Maximum annual rewards are prorated based on employment status: Full time 100%, part-time 50% and PRN 25%. To receive the reward, the team member must Note be actively employed on the date of the reward payment. Reward payments are subject to state and federal taxes. For questions about the Well-being Program, In addition to completing your wellness visit with your please contact Healthy Lives at 855-426-4325 PCP, you can work with our partner, Healthy Lives, and or visit www.ourhealthylives.org. You can also meet with a personal health coach to review your wellness get additional information by visiting our Total screening results, create a personal plan to help you Rewards site at fmolhs.org/totalrewards on the reach your health and well-being goals, and earn rewards for doing so. My Health and Well-being page. 32

Healthy Lives • www.ourhealthylives.org • 855-426-4325 Your medical information is private and protected. Your participation in the Healthy Lives Wellness program is your personal choice. The results of your screening and personal wellness plan are not shared with your employer. work environment that wants you to succeed. Timely health Healthy Lives Wellness Program topics are delivered via live remote presentations, podcasts, Working well begins with living well. We’re pleased in-person seminars and more. Everything is at your 昀椀ngertips to be a partner for your personal health journey. As a through the mobile Healthy Lives app to help you keep track bene昀椀t to every team member, we offer the Healthy Lives of your progress, review health and well-being activities Wellness Program to support and encourage individual to earn wellness points, and schedule the education that’s health goals. All team members can participate at no important to you. Your coach will make suggestions too! Here cost. Whether at home or work, these tools and personal are some of the options offered: coaching help each team member and their family Health identify what’s important to their health and well-being Wellness Classes Walking Groups Tobacco Cessation Coaching with a plan to achieve results. Body, mind and spirit – our Pregnancy Farm To Work Stretch Breaks Meal Planning wellness approach is comprehensive and complements Program your personal physician's care and personal health goals. Stress Diabetes Team Challenges Nutrition Education Management Prevention Personal Coaching and Kinesics Continual Education Kinesics is a platform to improve balance and mobility that is personalized to address your individual needs. Once the wellness visit and biometric screening are complete Schedule through the Healthy Lives app/portal, and with your PCP, schedule a one-on-one health coaching you will receive a full range of motion evaluation and session with Healthy Lives, Your health coach will explain the a one-on-one results review. Team members receive a screening results and create a personal plan to help you reach customized 昀氀exibility and mobility program that is 100% your health goals. You’ll be surrounded and supported by a unique to your body and includes video tutorials, so you feel con昀椀dent about executing your program. Healthy Lives Wellness App Take your plan and your progress with you everywhere using the mobile app. This interactive tool helps you keep track of total well-being and manage your healthy lifestyle choices. Through this mobile tracker, you’ll also stay connected to all of the Healthy Lives Wellness resources, including chats with a health coach. The app is free to download and compatible with all mobile devices. To learn more about the Health and Wellness Program and Healthy Lives, visit www.OurHealthyLives.org or call 855-426-4325 for Louisiana ministries or 601-200-6448 for Mississippi ministries. 33