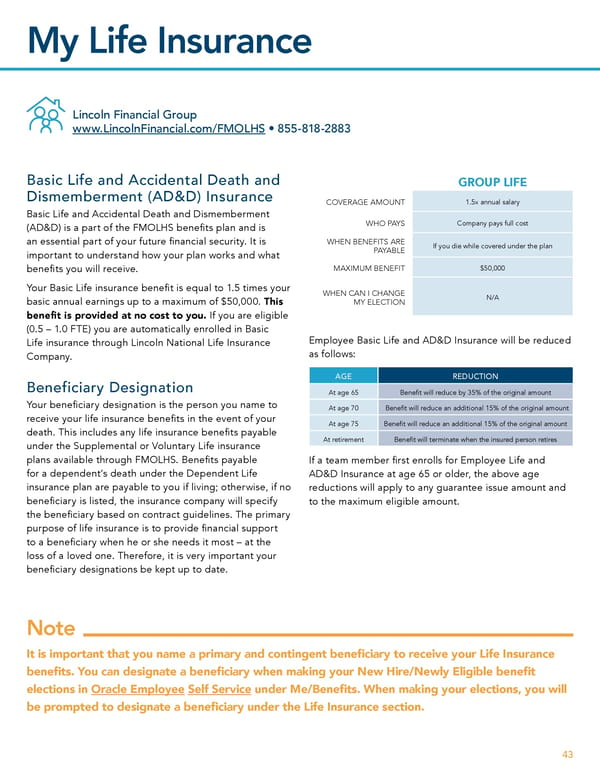

My Life Insurance Lincoln Financial Group www.LincolnFinancial.com/FMOLHS • 855-818-2883 Basic Life and Accidental Death and GROUP LIFE Dismemberment (AD&D) Insurance COVERAGE AMOUNT 1.5x annual salary Basic Life and Accidental Death and Dismemberment WHO PAYS Company pays full cost (AD&D) is a part of the FMOLHS bene昀椀ts plan and is WHEN BENEFITS ARE an essential part of your future 昀椀nancial security. It is PAYABLE If you die while covered under the plan important to understand how your plan works and what MAXIMUM BENEFIT $50,000 bene昀椀ts you will receive. Your Basic Life insurance bene昀椀t is equal to 1.5 times your WHEN CAN I CHANGE basic annual earnings up to a maximum of $50,000. This MY ELECTION N/A bene昀椀t is provided at no cost to you. If you are eligible (0.5 – 1.0 FTE) you are automatically enrolled in Basic Employee Basic Life and AD&D Insurance will be reduced Life insurance through Lincoln National Life Insurance as follows: Company. AGE REDUCTION Beneficiary Designation At age 65 Bene昀椀t will reduce by 35% of the original amount Your bene昀椀ciary designation is the person you name to At age 70 Bene昀椀t will reduce an additional 15% of the original amount receive your life insurance bene昀椀ts in the event of your At age 75 Bene昀椀t will reduce an additional 15% of the original amount death. This includes any life insurance bene昀椀ts payable At retirement Bene昀椀t will terminate when the insured person retires under the Supplemental or Voluntary Life insurance plans available through FMOLHS. Bene昀椀ts payable If a team member 昀椀rst enrolls for Employee Life and for a dependent’s death under the Dependent Life AD&D Insurance at age 65 or older, the above age insurance plan are payable to you if living; otherwise, if no reductions will apply to any guarantee issue amount and bene昀椀ciary is listed, the insurance company will specify to the maximum eligible amount. the bene昀椀ciary based on contract guidelines. The primary purpose of life insurance is to provide 昀椀nancial support to a bene昀椀ciary when he or she needs it most – at the loss of a loved one. Therefore, it is very important your bene昀椀ciary designations be kept up to date. Note It is important that you name a primary and contingent bene昀椀ciary to receive your Life Insurance bene昀椀ts. You can designate a bene昀椀ciary when making your New Hire/Newly Eligible bene昀椀t elections in Oracle Employee Self Service under Me/Bene昀椀ts. When making your elections, you will be prompted to designate a bene昀椀ciary under the Life Insurance section. 43

Team Member Guide to Benefit Enrollment Page 42 Page 44

Team Member Guide to Benefit Enrollment Page 42 Page 44