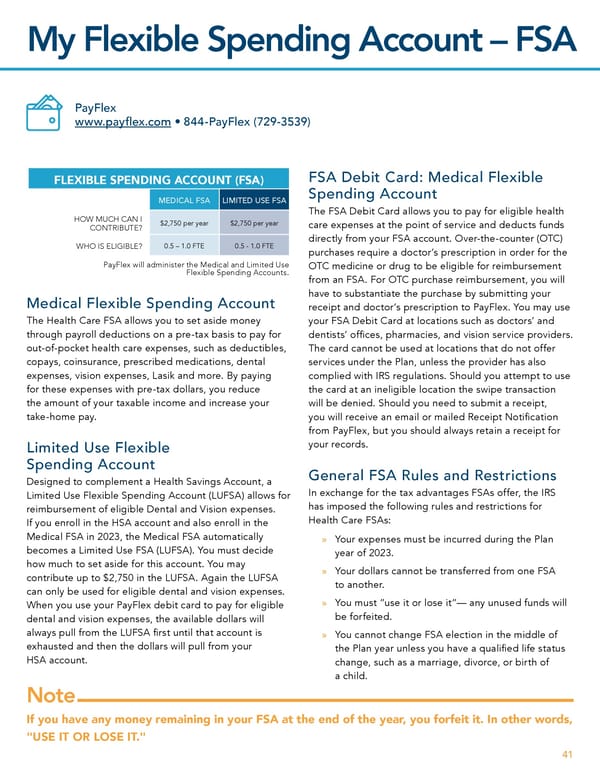

My Flexible Spending Account – FSA PayFlex www.pay昀氀ex.com • 844-PayFlex (729-3539) FSA Debit Card: Medical Flexible FLEXIBLE SPENDING ACCOUNT (FSA) Spending Account MEDICAL FSA LIMITED USE FSA HOW MUCH CAN I The FSA Debit Card allows you to pay for eligible health $2,750 per year $2,750 per year CONTRIBUTE? care expenses at the point of service and deducts funds directly from your FSA account. Over-the-counter (OTC) WHO IS ELIGIBLE? 0.5 – 1.0 FTE 0.5 - 1.0 FTE purchases require a doctor’s prescription in order for the PayFlex will administer the Medical and Limited Use OTC medicine or drug to be eligible for reimbursement Flexible Spending Accounts. from an FSA. For OTC purchase reimbursement, you will have to substantiate the purchase by submitting your Medical Flexible Spending Account receipt and doctor’s prescription to PayFlex. You may use The Health Care FSA allows you to set aside money your FSA Debit Card at locations such as doctors’ and through payroll deductions on a pre-tax basis to pay for dentists’ of昀椀ces, pharmacies, and vision service providers. out-of-pocket health care expenses, such as deductibles, The card cannot be used at locations that do not offer copays, coinsurance, prescribed medications, dental services under the Plan, unless the provider has also expenses, vision expenses, Lasik and more. By paying complied with IRS regulations. Should you attempt to use for these expenses with pre-tax dollars, you reduce the card at an ineligible location the swipe transaction the amount of your taxable income and increase your will be denied. Should you need to submit a receipt, take-home pay. you will receive an email or mailed Receipt Noti昀椀cation from PayFlex, but you should always retain a receipt for your records. Limited Use Flexible Spending Account General FSA Rules and Restrictions Designed to complement a Health Savings Account, a In exchange for the tax advantages FSAs offer, the IRS Limited Use Flexible Spending Account (LUFSA) allows for has imposed the following rules and restrictions for reimbursement of eligible Dental and Vision expenses. Health Care FSAs: If you enroll in the HSA account and also enroll in the Medical FSA in 2023, the Medical FSA automatically » Your expenses must be incurred during the Plan becomes a Limited Use FSA (LUFSA). You must decide year of 2023. how much to set aside for this account. You may » Your dollars cannot be transferred from one FSA contribute up to $2,750 in the LUFSA. Again the LUFSA to another. can only be used for eligible dental and vision expenses. » You must “use it or lose it”— any unused funds will When you use your PayFlex debit card to pay for eligible be forfeited. dental and vision expenses, the available dollars will always pull from the LUFSA 昀椀rst until that account is » You cannot change FSA election in the middle of exhausted and then the dollars will pull from your the Plan year unless you have a quali昀椀ed life status HSA account. change, such as a marriage, divorce, or birth of Note a child. If you have any money remaining in your FSA at the end of the year, you forfeit it. In other words, "USE IT OR LOSE IT." 41

Team Member Guide to Benefit Enrollment Page 40 Page 42

Team Member Guide to Benefit Enrollment Page 40 Page 42