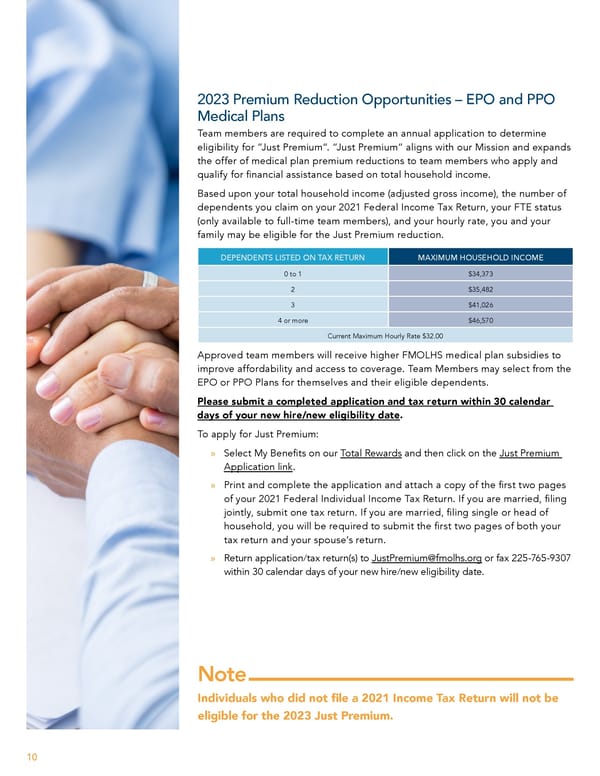

2023 Premium Reduction Opportunities – EPO and PPO Medical Plans Team members are required to complete an annual application to determine eligibility for “Just Premium”. “Just Premium” aligns with our Mission and expands the offer of medical plan premium reductions to team members who apply and qualify for 昀椀nancial assistance based on total household income. Based upon your total household income (adjusted gross income), the number of dependents you claim on your 2021 Federal Income Tax Return, your FTE status (only available to full-time team members), and your hourly rate, you and your family may be eligible for the Just Premium reduction. DEPENDENTS LISTED ON TAX RETURN MAXIMUM HOUSEHOLD INCOME 0 to 1 $34,373 2 $35,482 3 $41,026 4 or more $46,570 Current Maximum Hourly Rate $32.00 Approved team members will receive higher FMOLHS medical plan subsidies to improve affordability and access to coverage. Team Members may select from the EPO or PPO Plans for themselves and their eligible dependents. Please submit a completed application and tax return within 30 calendar days of your new hire/new eligibility date. To apply for Just Premium: » Select My Bene昀椀ts on our Total Rewards and then click on the Just Premium Application link. » Print and complete the application and attach a copy of the 昀椀rst two pages of your 2021 Federal Individual Income Tax Return. If you are married, 昀椀ling jointly, submit one tax return. If you are married, 昀椀ling single or head of household, you will be required to submit the 昀椀rst two pages of both your tax return and your spouse’s return. » Return application/tax return(s) to JustPremium@fmolhs.org or fax 225-765-9307 within 30 calendar days of your new hire/new eligibility date. Note Individuals who did not 昀椀le a 2021 Income Tax Return will not be eligible for the 2023 Just Premium. 10

Team Member Guide to Benefit Enrollment Page 9 Page 11

Team Member Guide to Benefit Enrollment Page 9 Page 11