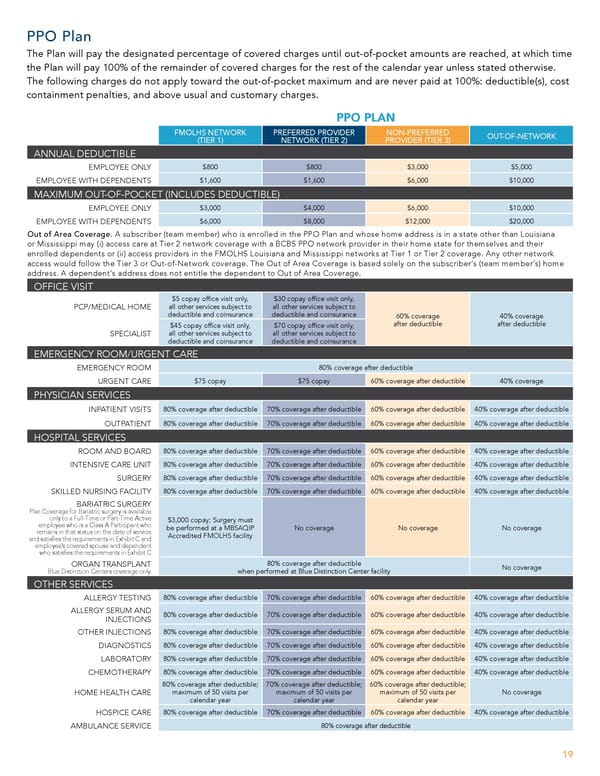

PPO Plan The Plan will pay the designated percentage of covered charges until out-of-pocket amounts are reached, at which time the Plan will pay 100% of the remainder of covered charges for the rest of the calendar year unless stated otherwise. The following charges do not apply toward the out-of-pocket maximum and are never paid at 100%: deductible(s), cost containment penalties, and above usual and customary charges. PPO PLAN FMOLHS NETWORK PREFERRED PROVIDER NON-PREFERRED OUT-OF-NETWORK (TIER 1) NETWORK (TIER 2) PROVIDER (TIER 3) ANNUAL DEDUCTIBLE EMPLOYEE ONLY $800 $800 $3,000 $5,000 EMPLOYEE WITH DEPENDENTS $1,600 $1,600 $6,000 $10,000 MAXIMUM OUT-OF-POCKET (INCLUDES DEDUCTIBLE) EMPLOYEE ONLY $3,000 $4,000 $6,000 $10,000 EMPLOYEE WITH DEPENDENTS $6,000 $8,000 $12,000 $20,000 Out of Area Coverage. A subscriber (team member) who is enrolled in the PPO Plan and whose home address is in a state other than Louisiana or Mississippi may (i) access care at Tier 2 network coverage with a BCBS PPO network provider in their home state for themselves and their enrolled dependents or (ii) access providers in the FMOLHS Louisiana and Mississippi networks at Tier 1 or Tier 2 coverage. Any other network access would follow the Tier 3 or Out-of-Network coverage. The Out of Area Coverage is based solely on the subscriber’s (team member’s) home address. A dependent’s address does not entitle the dependent to Out of Area Coverage. OFFICE VISIT $5 copay of昀椀ce visit only, $30 copay of昀椀ce visit only, PCP/MEDICAL HOME all other services subject to all other services subject to deductible and coinsurance deductible and coinsurance 60% coverage 40% coverage after deductible after deductible $45 copay of昀椀ce visit only, $70 copay of昀椀ce visit only, SPECIALIST all other services subject to all other services subject to deductible and coinsurance deductible and coinsurance EMERGENCY ROOM/URGENT CARE EMERGENCY ROOM 80% coverage after deductible URGENT CARE $75 copay $75 copay 60% coverage after deductible 40% coverage PHYSICIAN SERVICES INPATIENT VISITS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible OUTPATIENT 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible HOSPITAL SERVICES ROOM AND BOARD 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible INTENSIVE CARE UNIT 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible SURGERY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible SKILLED NURSING FACILITY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible BARIATRIC SURGERY Plan Coverage for Bariatric surgery is available only to a Full-Time or Part-Time Active $3,000 copay; Surgery must employee who is a Class A Participant who be performed at a MBSAQIP No coverage No coverage No coverage remains in that status on the date of service Accredited FMOLHS facility and satis昀椀es the requirements in Exhibit C and employee’s covered spouse and dependent who satis昀椀es the requirements in Exhibit C ORGAN TRANSPLANT 80% coverage after deductible No coverage Blue Distinction Centers coverage only. when performed at Blue Distinction Center facility OTHER SERVICES ALLERGY TESTING 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible ALLERGY SERUM AND INJECTIONS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible OTHER INJECTIONS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible DIAGNOSTICS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible LABORATORY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible CHEMOTHERAPY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible 80% coverage after deductible; 70% coverage after deductible; 60% coverage after deductible; HOME HEALTH CARE maximum of 50 visits per maximum of 50 visits per maximum of 50 visits per No coverage calendar year calendar year calendar year HOSPICE CARE 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible AMBULANCE SERVICE 80% coverage after deductible 19

Team Member Guide to Benefit Enrollment Page 18 Page 20

Team Member Guide to Benefit Enrollment Page 18 Page 20