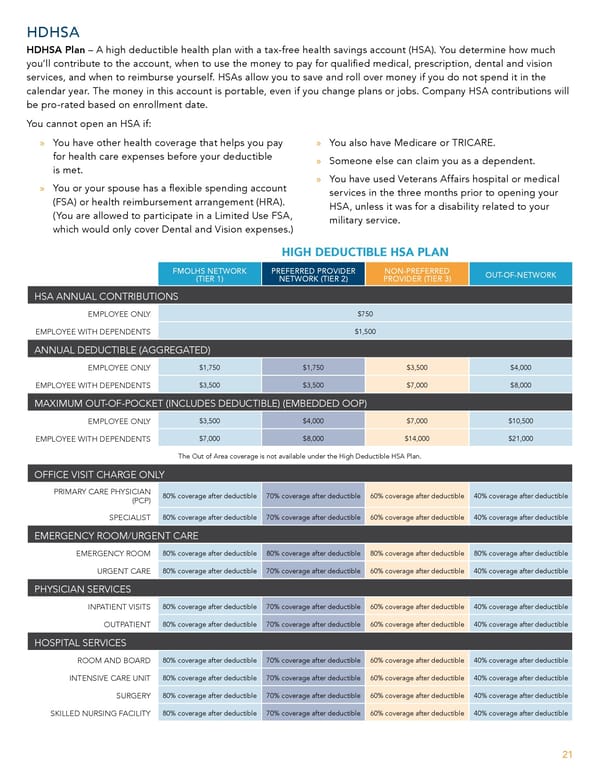

HDHSA HDHSA Plan – A high deductible health plan with a tax-free health savings account (HSA). You determine how much you’ll contribute to the account, when to use the money to pay for quali昀椀ed medical, prescription, dental and vision services, and when to reimburse yourself. HSAs allow you to save and roll over money if you do not spend it in the calendar year. The money in this account is portable, even if you change plans or jobs. Company HSA contributions will be pro-rated based on enrollment date. You cannot open an HSA if: » You have other health coverage that helps you pay » You also have Medicare or TRICARE. for health care expenses before your deductible » Someone else can claim you as a dependent. is met. » You have used Veterans Affairs hospital or medical » You or your spouse has a 昀氀exible spending account services in the three months prior to opening your (FSA) or health reimbursement arrangement (HRA). HSA, unless it was for a disability related to your (You are allowed to participate in a Limited Use FSA, military service. which would only cover Dental and Vision expenses.) HIGH DEDUCTIBLE HSA PLAN FMOLHS NETWORK PREFERRED PROVIDER NON-PREFERRED OUT-OF-NETWORK (TIER 1) NETWORK (TIER 2) PROVIDER (TIER 3) HSA ANNUAL CONTRIBUTIONS EMPLOYEE ONLY $750 EMPLOYEE WITH DEPENDENTS $1,500 ANNUAL DEDUCTIBLE (AGGREGATED) EMPLOYEE ONLY $1,750 $1,750 $3,500 $4,000 EMPLOYEE WITH DEPENDENTS $3,500 $3,500 $7,000 $8,000 MAXIMUM OUT-OF-POCKET (INCLUDES DEDUCTIBLE) (EMBEDDED OOP) EMPLOYEE ONLY $3,500 $4,000 $7,000 $10,500 EMPLOYEE WITH DEPENDENTS $7,000 $8,000 $14,000 $21,000 The Out of Area coverage is not available under the High Deductible HSA Plan. OFFICE VISIT CHARGE ONLY PRIMARY CARE PHYSICIAN (PCP) 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible SPECIALIST 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible EMERGENCY ROOM/URGENT CARE EMERGENCY ROOM 80% coverage after deductible 80% coverage after deductible 80% coverage after deductible 80% coverage after deductible URGENT CARE 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible PHYSICIAN SERVICES INPATIENT VISITS 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible OUTPATIENT 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible HOSPITAL SERVICES ROOM AND BOARD 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible INTENSIVE CARE UNIT 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible SURGERY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible SKILLED NURSING FACILITY 80% coverage after deductible 70% coverage after deductible 60% coverage after deductible 40% coverage after deductible 21

Team Member Guide to Benefit Enrollment Page 20 Page 22

Team Member Guide to Benefit Enrollment Page 20 Page 22